How Does Uber Show Up on Your Bank Statement?

Uber has transformed transportation, making it incredibly simple to request a ride and reach your destination with just a few taps on your smartphone. However, when it comes to reviewing your bank statement after a ride, identifying Uber transactions can sometimes be confusing due to the way these transactions are billed and recorded.

This guide will help you understand how Uber transactions typically appear on your bank or credit card statement and how to recognize them.

How Does Uber Show Up on Bank Statements?

Uber uses Adyen, their payment processor, to handle the money you pay for rides you take. The transaction between this and your bank or credit card is handled by Adyen. Both the bank you use and Adyen’s billing system have an impact on how the transaction shows up on your bank account.

Typical Descriptions for Uber Transactions

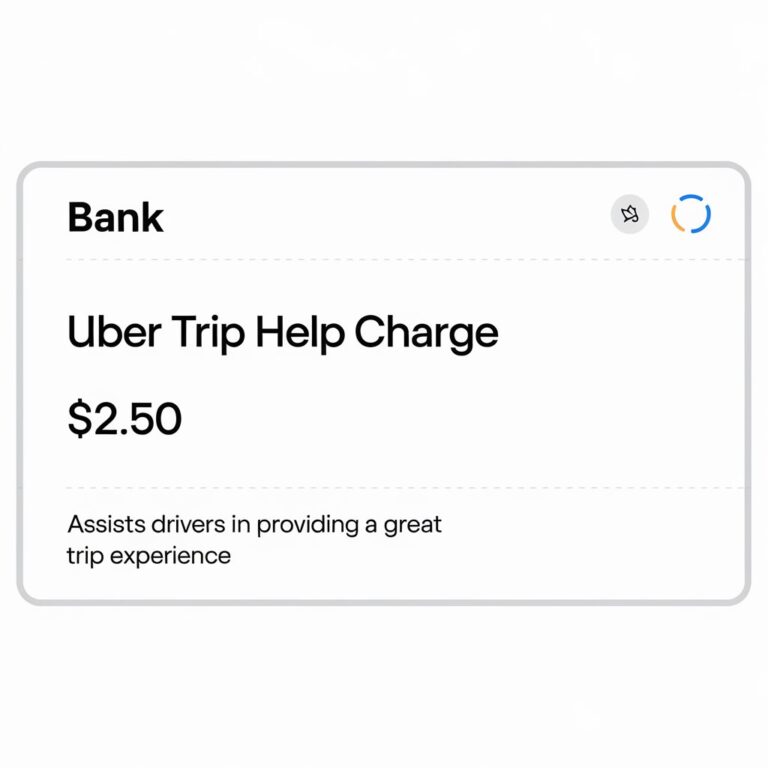

These transactions generally show up on bank statements under specific descriptors that indicate both the service and the location where the ride occurred. The most common descriptors you might see include:

- “Uber BV”: This descriptor often includes the location where the ride took place. For instance, if you took a ride in New York City, the charge might appear as “Uber BV New York.”

- “UBER Trip”**: This is another common descriptor that might be followed by the city or region. For example, a ride in San Francisco might appear as “Uber Trip San Francisco.”

- “Uber Technologies Inc.”: This descriptor is sometimes used in combination with the location. For instance, a charge could appear as “Uber Technologies Inc. New York.”

These descriptors help in identifying that the charge is related to an Uber ride and indicate the city or region where the service was utilized.

Also read Scores Matter Charge on Your Bank Statement.

Understanding Location-Based Descriptions

The location mentioned in the transaction description is particularly useful for users who frequently travel or take rides in various cities. It allows you to quickly verify if the charge corresponds to a ride you remember taking in a specific area. For example, if you notice a charge that reads “Uber BV San Francisco” and you recently visited San Francisco, it’s easy to correlate this with a ride you took there.

Why these Charges May Be Confusing?

There are a few reasons why these charges might be difficult to recognize on your bank statement:

Multiple Descriptors: These transactions can appear under different names depending on factors like location, the payment processor used, and the bank issuing the statement. This variation can make it challenging to immediately identify the charge as being from Uber.

Bundled Charges: If you took multiple rides in a short period, the charges might be bundled together, making it harder to distinguish between individual rides.

Time Lag: Sometimes, there’s a delay between when you take the ride and when the charge appears on your statement. This can cause confusion, especially if you’re reviewing your statement days or weeks after the ride occurred.

What these Charges are pending?

When you take an ride, you might notice a “pending” transaction on your bank statement before the final charge appears. This is a common practice used by Uber and other companies to verify that your payment method is valid and that your account has sufficient funds to cover the cost of the ride.

Understanding Pending Charges

Pending charges usually appear on your bank statement immediately after you complete ride. These charges include the ride’s cost along with a temporary authorization amount. The authorization is a hold placed on your payment method to ensure that the funds are available to cover the ride.

For example, if you take a ride in San Francisco that costs $15, you might see a pending charge labeled as “ubr* pending.uber.com san francisco ca” on your statement. This amount includes the ride’s cost and the temporary authorization.

The Role of Temporary Authorization

The temporary authorization is not an actual charge but a precautionary hold. It usually expires within a few days, at which point the final charge will replace the pending one on your statement. The amount of the authorization hold can vary depending on your bank’s policies and may be slightly higher or lower than the actual ride cost.

While seeing a pending charge might be concerning, it’s important to know that this is not a final charge to your account. The temporary hold will be removed by your bank within a few days, and the actual charge will take its place. Because these pending charges are not final, there’s no need to dispute them with Uber or your bank.

Tips for Identifying Transactions

To ensure you correctly identify these charges on your bank statement, consider the following tips:

Check the Date and Amount: Compare the date and amount of the charge on your bank statement with your ride history in the app. This can help confirm that the charge matches a specific trip you took.

Review Your Ride Receipts: Uber emails a receipt after every ride. Keeping track of these receipts can help you cross-reference charges on your statement.

Use the Uber App: This app keeps a record of all your rides, including the dates, times, and costs. Reviewing your ride history in the app can help you match transactions on your statement.

Learn about What Is the WUVISAAFT Charge on Your Bank Statement.

Preventing Unauthorized these Transactions

To protect your account from unauthorized transactions, consider the following steps:

Use a Strong Password: Ensure your Uber’s account is secured with a strong, unique password. Avoid using easily guessable passwords or reusing passwords from other accounts.

Enable Two-Factor Authentication (2FA): Two-factor authentication adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone, in addition to your password.

Regularly Review Account Information: Periodically review your “Uber” account details, especially the payment methods linked to your account. Make sure only authorized payment methods are associated with your account.

Update Payment Methods: Remove outdated or expired payment methods and add new ones as needed. Keeping your payment methods up to date can help prevent unauthorized transactions.

Monitor for Suspicious Activity: Regularly check your bank statements for any unauthorized transactions, including those from other sources, such as EBT Account Check. Promptly reporting any suspicious activity can help mitigate potential fraud.

Conclusion:

You may better manage your money and prevent misunderstanding by being aware of how Uber costs show on your bank statement. You may quickly validate costs and make sure they match your trips by being familiar with the common descriptors used for Uber’s transactions and knowing where to search for confirmation.

You may be certain that the charges on your bill, which are often accompanied with the location of your journey, are valid and connected to your Uber usage, regardless of whether you see “Uber BV,” “UBER* Trip,” or “Uber Technologies Inc.”